Your Wells fargo denied loan modification images are ready. Wells fargo denied loan modification are a topic that is being searched for and liked by netizens now. You can Get the Wells fargo denied loan modification files here. Get all free images.

If you’re searching for wells fargo denied loan modification pictures information related to the wells fargo denied loan modification topic, you have visit the ideal blog. Our site frequently gives you hints for downloading the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

Wells Fargo Denied Loan Modification. Wells Fargo Loan Modification Lawsuit 2021 Representing borrowers affected by the Wells Fargo calculation errors Gibbs Law Group was court-appointed co-lead counsel for a certified class of more than 500 home mortgage borrowers who lost their homes to foreclosure by Wells Fargo after a calculation error in the banks software caused it to erroneously deny class members trial mortgage modifications. The embattled bank revealed the issue in a. The condo is now worth more than what I owe. Written by Steve Rhode.

Wells Fargo Home Loan Class Action Settlement Top Class Actions From topclassactions.com

Wells Fargo Home Loan Class Action Settlement Top Class Actions From topclassactions.com

Reapplying with updated information if your circumstances have changed. Wells Fargo Loan Modification Lawsuit 2021 Representing borrowers affected by the Wells Fargo calculation errors Gibbs Law Group was court-appointed co-lead counsel for a certified class of more than 500 home mortgage borrowers who lost their homes to foreclosure by Wells Fargo after a calculation error in the banks software caused it to erroneously deny class members trial mortgage modifications. You may have other options instead of foreclosure and were here to help you understand them. Contact us today for a free legal consultation to learn your rights. Wells Fargo Bank uses proprietary underwriting software when handling applications for loan modifications. In a recent government filing Wells Fargo admitted to a very disconcerting set of facts.

Hundreds of customers were reportedly wrongly denied a loan modification due to Wells Fargos computer error.

Wells Fargo denied my loan modification. In November 2018 Wells Fargo increased these numbers to 870 and 545. If youve been denied a loan modification youre probably disappointed but dont give up. The embattled bank revealed the issue in a. Wells Fargo reveals software error wrongly denied much-needed mortgage modifications Big bank sets aside 8 million for remediation August 3 2018 621 pm By Ben Lane. They have estimated approximately 400 of the 625 homes were ultimately foreclosed on.

Source: topclassactions.com

Source: topclassactions.com

Culture 625 Wells Fargo Customers Denied Loan Modification Because Of Glitch Homes Were Foreclosed A computer glitch caused many to lose their homes when they possibly could have kept it through modification loans. It has been reported that Wells Fargo wrongfully denied hundreds of individuals who qualified for loan modifications under the federal Home Affordable Modification Program HAMP causing many to lose. Wells Fargo has acknowledged a processing error in a mortgage underwriting tool that has incorrectly denied or did not offer modifications to 625 customers. 625 People Denied Mortgage Loan Modifications and 400 Foreclosed On Because Wells Fargo. They have estimated approximately 400 of the 625 homes were ultimately foreclosed on.

Source: topclassactions.com

Source: topclassactions.com

The lawsuit seeks to certify the following nationwide class as well as a proposed Pennsylvania subclass. Reapplying with updated information if your circumstances have changed. After reviewing the information you provided we must advise you your request for Loan Modification has been denied for the following reason. The condo is now worth more than what I owe. I behind 7 months on mortgage payments on foreclosure.

Source: acgnow.com

Source: acgnow.com

Wells Fargo reveals software error wrongly denied much-needed mortgage modifications Big bank sets aside 8 million for remediation August 3 2018 621 pm By Ben Lane. These options may include one of the following. The condo is now worth more than what I owe. I behind 7 months on mortgage payments on foreclosure. After reviewing the information you provided we must advise you your request for Loan Modification has been denied for the following reason.

Source: dannlaw.com

Source: dannlaw.com

Written by Steve Rhode. The condo is now worth more than what I owe. Wells Fargo denied my loan modification. They have estimated approximately 400 of the 625 homes were ultimately foreclosed on. The embattled bank revealed the issue in a.

Source: fazziolaw.com

Source: fazziolaw.com

You may have other options instead of foreclosure and were here to help you understand them. It has been reported that Wells Fargo wrongfully denied hundreds of individuals who qualified for loan modifications under the federal Home Affordable Modification Program HAMP causing many to lose. Who else can I turn to. In a recent government filing Wells Fargo admitted to a very disconcerting set of facts. Reapplying with updated information if your circumstances have changed.

Source: fazziolaw.com

Source: fazziolaw.com

Hundreds of people had their homes foreclosed on after software used by Wells Fargo incorrectly denied them mortgage modifications. The embattled bank revealed the issue in a. Its important to understand that Wells Fargo like many banks may deny a request to modify a loan if the borrower is in arrears over a certain dollar amount. In a recent government filing Wells Fargo admitted to a very disconcerting set of facts. They have estimated approximately 400 of the 625 homes were ultimately foreclosed on.

Source: blog.amerihopealliance.com

Source: blog.amerihopealliance.com

It has been reported that Wells Fargo wrongfully denied hundreds of individuals who qualified for loan modifications under the federal Home Affordable Modification Program HAMP causing many to lose. According to the complaint the plaintiff owned one of roughly 500 homes foreclosed upon due to Wells Fargos erroneous HAMP modification denials. If youve been denied a loan modification youre probably disappointed but dont give up. I owe about 24k in. Applying for a short sale.

Source: wellsfargo.com

Source: wellsfargo.com

You may have other options instead of foreclosure and were here to help you understand them. If youve been denied a loan modification youre probably disappointed but dont give up. The lawsuit seeks to certify the following nationwide class as well as a proposed Pennsylvania subclass. Applying for a short sale. If this is the case with your loan the bank may allow you to enter another repayment plan in order to lower your arrears at which time you can reapply for a loan modification.

Source: pl.pinterest.com

Source: pl.pinterest.com

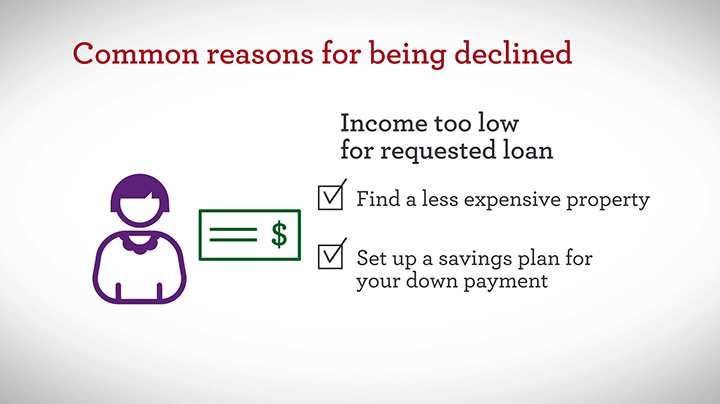

After reviewing the information you provided we must advise you your request for Loan Modification has been denied for the following reason. Written by Steve Rhode. Applying for a short sale. Basedon the information provided your monthly income totaled 825983 and your expenses totaled 805814 which indicates you do not have the ability to afford a modified payment plan. In a recent government filing Wells Fargo admitted to a very disconcerting set of facts.

Source: line.17qq.com

Source: line.17qq.com

Culture 625 Wells Fargo Customers Denied Loan Modification Because Of Glitch Homes Were Foreclosed A computer glitch caused many to lose their homes when they possibly could have kept it through modification loans. Well the sad fact is that not everyone will qualify for a loan workout so you need to be sure you understand why you could be denied a loan modification - then you will be able to avoid those areas that could spell trouble for your application. Wells Fargo has acknowledged a processing error in a mortgage underwriting tool that has incorrectly denied or did not offer modifications to 625 customers. Wells Fargo must face lawsuits by homeowners with Wells Fargo mortgages who claim the largest Wells Fargo refused to offer them permanent mortgage modifications for which they had qualified. Written by Steve Rhode.

In November 2018 Wells Fargo increased these numbers to 870 and 545. You may have other options instead of foreclosure and were here to help you understand them. It has been reported that Wells Fargo wrongfully denied hundreds of individuals who qualified for loan modifications under the federal Home Affordable Modification Program HAMP causing many to lose. After reviewing the information you provided we must advise you your request for Loan Modification has been denied for the following reason. Initially Wells Fargo said that around 600 customers were incorrectly denied a loan modification or were not offered a modification in cases where they would have otherwise qualified and that in about 400 of these cases the bank eventually foreclosed.

Source: krcomplexlit.com

Source: krcomplexlit.com

The condo is now worth more than what I owe. The embattled bank revealed the issue in a. These options may include one of the following. I owe about 24k in. Applying for a short sale.

Source: acgnow.com

Source: acgnow.com

Initially Wells Fargo said that around 600 customers were incorrectly denied a loan modification or were not offered a modification in cases where they would have otherwise qualified and that in about 400 of these cases the bank eventually foreclosed. If this is the case with your loan the bank may allow you to enter another repayment plan in order to lower your arrears at which time you can reapply for a loan modification. Wells Fargo Loan Modification Lawsuit 2021 Representing borrowers affected by the Wells Fargo calculation errors Gibbs Law Group was court-appointed co-lead counsel for a certified class of more than 500 home mortgage borrowers who lost their homes to foreclosure by Wells Fargo after a calculation error in the banks software caused it to erroneously deny class members trial mortgage modifications. Wells Fargo reveals software error wrongly denied much-needed mortgage modifications Big bank sets aside 8 million for remediation August 3 2018 621 pm By Ben Lane. The embattled bank revealed the issue in a.

Source: oaktreelaw.com

Source: oaktreelaw.com

They have estimated approximately 400 of the 625 homes were ultimately foreclosed on. Reapplying with updated information if your circumstances have changed. Contact us today for a free legal consultation to learn your rights. I owe about 24k in. Applying for a short sale.

Source: dannlaw.com

Source: dannlaw.com

Wells Fargo Bank uses proprietary underwriting software when handling applications for loan modifications. Initially Wells Fargo said that around 600 customers were incorrectly denied a loan modification or were not offered a modification in cases where they would have otherwise qualified and that in about 400 of these cases the bank eventually foreclosed. If youve been denied a loan modification youre probably disappointed but dont give up. You may have other options instead of foreclosure and were here to help you understand them. Reapplying with updated information if your circumstances have changed.

Source: wellsfargo.com

Source: wellsfargo.com

According to the complaint the plaintiff owned one of roughly 500 homes foreclosed upon due to Wells Fargos erroneous HAMP modification denials. Applying for a short sale. Wells Fargo denied my loan modification. Culture 625 Wells Fargo Customers Denied Loan Modification Because Of Glitch Homes Were Foreclosed A computer glitch caused many to lose their homes when they possibly could have kept it through modification loans. Reapplying with updated information if your circumstances have changed.

Source: mfi-miami.com

Source: mfi-miami.com

They have estimated approximately 400 of the 625 homes were ultimately foreclosed on. In a recent government filing Wells Fargo admitted to a very disconcerting set of facts. Wells Fargo Bank uses proprietary underwriting software when handling applications for loan modifications. They have estimated approximately 400 of the 625 homes were ultimately foreclosed on. Initially Wells Fargo said that around 600 customers were incorrectly denied a loan modification or were not offered a modification in cases where they would have otherwise qualified and that in about 400 of these cases the bank eventually foreclosed.

Source: housingwire.com

Source: housingwire.com

I applied for a loan mod but they turned me down stating that I did not provide enough evidence of hardship. Well the sad fact is that not everyone will qualify for a loan workout so you need to be sure you understand why you could be denied a loan modification - then you will be able to avoid those areas that could spell trouble for your application. In August 2018 Wells Fargo Bank admitted that there were customers who applied for loan modifications and due to a computing miscalculation with this underwriting software were denied even when they qualified. Hoping that you will be approved for a Wells Fargo loan modification that will lower your monthly mortgage payment. Applying for a short sale.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title wells fargo denied loan modification by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.