Your Chase class action lawsuit loan modification images are ready. Chase class action lawsuit loan modification are a topic that is being searched for and liked by netizens now. You can Get the Chase class action lawsuit loan modification files here. Download all free vectors.

If you’re looking for chase class action lawsuit loan modification images information related to the chase class action lawsuit loan modification keyword, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for seeing the maximum quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

Chase Class Action Lawsuit Loan Modification. See September 28 2010 Loan Modification attached hereto as Exhibit 4. New Chases mortgage modification class-action lawsuit. The JPMorgan Chase class action lawsuit settlement states that for the next three years annual audits will confirm that individuals who owe no debt to Chase retain no interest in any property securing a debt owed to Chase and have no other account with Chase will be exluded. San Francisco CA.

Major Jpmorgan Chase Settlements And Fines From usatoday.com

Major Jpmorgan Chase Settlements And Fines From usatoday.com

Per the terms of the settlement Class Members are eligible to receive between 75 and 500 or an amount previously determined. A lawsuit against JP Morgan-Chase the nations largest bank asserts that the institution paid off the 4200000000 in mortgage forgiveness that it agreed to as a. A class action suit should be levied against Chase Mortgage for loan modification fraud. The lawsuit was filed by the company California underwriters who alleged the bank failed. I started this process in Feb. A preliminary 950000 settlement has been reached in a California labor law class action lawsuit pending against JP Morgan Chase Bank NA.

On September 28 2010 Chase Home Finance entered into a loan modification agreement with the Pulleys which amended the original mortgage on their property.

With respect to the loan modification you sought there is a national class action lawsuit against JPMorgan Chase concerning its breaches of trial modification agreements it offered to borrowers pursuant to the federal governments Home Affordable Mortgage Program. That loan modification agreement did not change the Pulleys obligations with respect to wind insurance. I was essentially guaranteed it would only take 3 months but still no answer. I started this process in Feb. 09 and it is now 17 months later and still no answer. A preliminary 950000 settlement has been reached in a California labor law class action lawsuit pending against JP Morgan Chase Bank NA.

Source: topclassactions.com

Source: topclassactions.com

The plaintiff claims she and other consumers were tricked by the bank into believing they had received loan modifications for their primary mortgages. IStocksubman JPMorgan Chase Co. On September 28 2010 Chase Home Finance entered into a loan modification agreement with the Pulleys which amended the original mortgage on their property. NEW YORK Reuters - A federal judge rejected JPMorgan Chase Cos JPMN bid to dismiss a lawsuit accusing it of misleading thousands of cash. JPMorgan Chase Co which does business as Chase Bank is on the receiving end of a proposed class action over alleged Fair Debt Collection Practices Act FDCPA violations.

Will pay 195 million to more than 200 current and former black financial advisers and their attorneys in a class action. The JPMorgan Chase class action lawsuit settlement states that for the next three years annual audits will confirm that individuals who owe no debt to Chase retain no interest in any property securing a debt owed to Chase and have no other account with Chase will be exluded. That loan modification agreement did not change the Pulleys obligations with respect to wind insurance. I started the process of modifying my loan after my income fell by more than 50. November 17 2020.

Per the terms of the settlement Class Members are eligible to receive between 75 and 500 or an amount previously determined. I started the process of modifying my loan after my income fell by more than 50. State Attorneys General and other entities have filed class-action lawsuits against many mortgage investors and mortgage servicers over alleged foreclosure errors alleged missing documents alleged business practices that they do not like mortgage loan modifications and other matters. Will pay 195 million to more than 200 current and former black financial advisers and their attorneys in a class action. A class action lawsuit has been filed against Chase Home Finance LLC and JPMorgan Chase NA.

Source: topclassactions.com

Source: topclassactions.com

State Attorneys General and other entities have filed class-action lawsuits against many mortgage investors and mortgage servicers over alleged foreclosure errors alleged missing documents alleged business practices that they do not like mortgage loan modifications and other matters. The plaintiff claims she and other consumers were tricked by the bank into believing they had received loan modifications for their primary mortgages. I started the process of modifying my loan after my income fell by more than 50. A class action is a lawsuit in which one or more plaintiffs in this case Arkady Milgram the Plaintiff sue on. Chase Bank denies the allegations but has agreed to settle the Chase Bank fees SCRA violation class action lawsuit in the interest of avoiding the continued costs and risks of litigation.

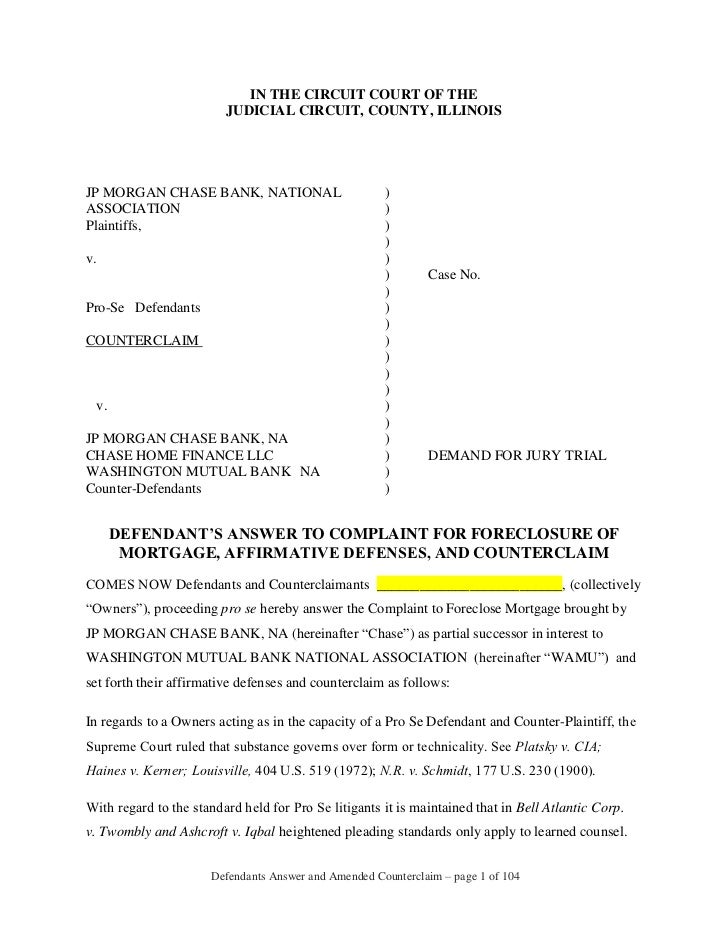

Source: slideshare.net

Source: slideshare.net

If you entered into a loan modification serviced by Chase had a PMI Automatic Termination Date on or after April 1 2013 and made one or more payments for PMI after your Automatic Termination Date and before the date if any that Chase ceased servicing your loan and those payments were not fully refunded to you a PMI Overpayment you have a right to know about a proposed settlement. On September 28 2010 Chase Home Finance entered into a loan modification agreement with the Pulleys which amended the original mortgage on their property. A lawsuit against JP Morgan-Chase the nations largest bank asserts that the institution paid off the 4200000000 in mortgage forgiveness that it agreed to as a. On July 26 2009 Girard Gibbs LLP and co-counsel filed a consolidated class action lawsuit against Chase on behalf of a national class of consumers in the District Court of Northern California. See September 28 2010 Loan Modification attached hereto as Exhibit 4.

The lawsuit was filed by the company California underwriters who alleged the bank failed. If you entered into a loan modification serviced by Chase had a PMI Automatic Termination Date on or after April 1 2013 and made one or more payments for PMI after your Automatic Termination Date and before the date if any that Chase ceased servicing your loan and those payments were not fully refunded to you a PMI Overpayment you have a right to know about a proposed settlement. To grant permanent mortgage modifications if they get class-action status. The complaint alleges that beginning in November 2008 Chase began notifying consumers participating in the low APR fixed for life offers that their minimum monthly payment would increase from 2 of the loan balance to 5 of the loan. In early 2009 Lam contacted Washington Mutual since absorbed by Chase about a modification after his.

Source: nz.pinterest.com

Source: nz.pinterest.com

The JPMorgan Chase class action lawsuit settlement states that for the next three years annual audits will confirm that individuals who owe no debt to Chase retain no interest in any property securing a debt owed to Chase and have no other account with Chase will be exluded. IStocksubman JPMorgan Chase Co. That case which is pending in federal court in Massachusetts has not settled. One of the plaintiffs Alex Lam a 35-year-old restaurant manager alleges Chase told him to actually stop making payments in order to be eligible for help. San Francisco CA.

Source: topclassactions.com

Source: topclassactions.com

The lawsuit was filed by the company California underwriters who alleged the bank failed. 09 and it is now 17 months later and still no answer. On July 26 2009 Girard Gibbs LLP and co-counsel filed a consolidated class action lawsuit against Chase on behalf of a national class of consumers in the District Court of Northern California. IStocksubman JPMorgan Chase Co. That loan modification agreement did not change the Pulleys obligations with respect to wind insurance.

Source: classaction.org

Source: classaction.org

New Chases mortgage modification class-action lawsuit. IStocksubman JPMorgan Chase Co. JP Morgan Chase Class Action Settlement. The complaint alleges that beginning in November 2008 Chase began notifying consumers participating in the low APR fixed for life offers that their minimum monthly payment would increase from 2 of the loan balance to 5 of the loan. I started this process in Feb.

Source: topclassactions.com

Source: topclassactions.com

The plaintiff claims she and other consumers were tricked by the bank into believing they had received loan modifications for their primary mortgages. A lawsuit against JP Morgan-Chase the nations largest bank asserts that the institution paid off the 4200000000 in mortgage forgiveness that it agreed to as a. Per the terms of the settlement Class Members are eligible to receive between 75 and 500 or an amount previously determined. If you entered into a loan modification serviced by Chase had a PMI Automatic Termination Date on or after April 1 2013 and made one or more payments for PMI after your Automatic Termination Date and before the date if any that Chase ceased servicing your loan and those payments were not fully refunded to you a PMI Overpayment you have a right to know about a proposed settlement. The plaintiff claims she and other consumers were tricked by the bank into believing they had received loan modifications for their primary mortgages.

Source: in.pinterest.com

Source: in.pinterest.com

With respect to the loan modification you sought there is a national class action lawsuit against JPMorgan Chase concerning its breaches of trial modification agreements it offered to borrowers pursuant to the federal governments Home Affordable Mortgage Program. The plaintiff claims she and other consumers were tricked by the bank into believing they had received loan modifications for their primary mortgages. The JPMorgan Chase class action lawsuit settlement states that for the next three years annual audits will confirm that individuals who owe no debt to Chase retain no interest in any property securing a debt owed to Chase and have no other account with Chase will be exluded. If you entered into a loan modification serviced by Chase had a PMI Automatic Termination Date on or after April 1 2013 and made one or more payments for PMI after your Automatic Termination Date and before the date if any that Chase ceased servicing your loan and those payments were not fully refunded to you a PMI Overpayment you have a right to know about a proposed settlement. San Francisco CA.

Source: yumpu.com

Source: yumpu.com

If you entered into a loan modification serviced by Chase had a PMI Automatic Termination Date on or after April 1 2013 and made one or more payments for PMI after your Automatic Termination Date and before the date if any that Chase ceased servicing your loan and those payments were not fully refunded to you a PMI Overpayment you have a right to know about a proposed settlement. I was essentially guaranteed it would only take 3 months but still no answer. The plaintiff claims she and other consumers were tricked by the bank into believing they had received loan modifications for their primary mortgages. That case which is pending in federal court in Massachusetts has not settled. JP Morgan Chase Class Action Settlement.

Source: topclassactions.com

Source: topclassactions.com

The JPMorgan Chase class action lawsuit settlement states that for the next three years annual audits will confirm that individuals who owe no debt to Chase retain no interest in any property securing a debt owed to Chase and have no other account with Chase will be exluded. November 17 2020. On July 26 2009 Girard Gibbs LLP and co-counsel filed a consolidated class action lawsuit against Chase on behalf of a national class of consumers in the District Court of Northern California. In early 2009 Lam contacted Washington Mutual since absorbed by Chase about a modification after his. JPMorgan Chase Co which does business as Chase Bank is on the receiving end of a proposed class action over alleged Fair Debt Collection Practices Act FDCPA violations.

Source: topclassactions.com

Source: topclassactions.com

A class action lawsuit has been filed against Chase Home Finance LLC and JPMorgan Chase NA. The JPMorgan Chase class action lawsuit settlement states that for the next three years annual audits will confirm that individuals who owe no debt to Chase retain no interest in any property securing a debt owed to Chase and have no other account with Chase will be exluded. A class action is a lawsuit in which one or more plaintiffs in this case Arkady Milgram the Plaintiff sue on. One of the plaintiffs Alex Lam a 35-year-old restaurant manager alleges Chase told him to actually stop making payments in order to be eligible for help. The complaint alleges that beginning in November 2008 Chase began notifying consumers participating in the low APR fixed for life offers that their minimum monthly payment would increase from 2 of the loan balance to 5 of the loan.

Source: usatoday.com

Source: usatoday.com

One of the lawsuits against Bank of Americagroup sued Chase accusing. The complaint alleges that beginning in November 2008 Chase began notifying consumers participating in the low APR fixed for life offers that their minimum monthly payment would increase from 2 of the loan balance to 5 of the loan. Per the terms of the settlement Class Members are eligible to receive between 75 and 500 or an amount previously determined. Chase Bank denies the allegations but has agreed to settle the Chase Bank fees SCRA violation class action lawsuit in the interest of avoiding the continued costs and risks of litigation. San Francisco CA.

Source: topclassactions.com

Source: topclassactions.com

The plaintiff claims she and other consumers were tricked by the bank into believing they had received loan modifications for their primary mortgages. A class action suit should be levied against Chase Mortgage for loan modification fraud. Chase Bank denies the allegations but has agreed to settle the Chase Bank fees SCRA violation class action lawsuit in the interest of avoiding the continued costs and risks of litigation. A class action is a lawsuit in which one or more plaintiffs in this case Arkady Milgram the Plaintiff sue on. In early 2009 Lam contacted Washington Mutual since absorbed by Chase about a modification after his.

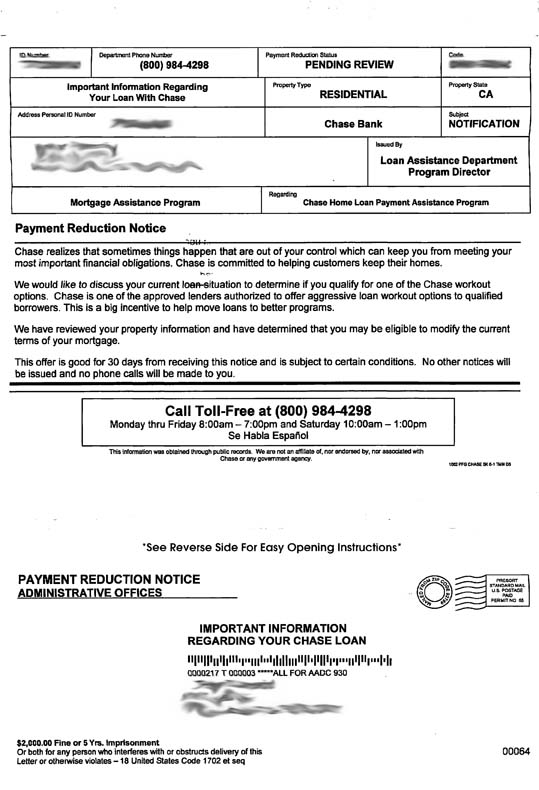

Source: chase-sucks.org

Source: chase-sucks.org

The plaintiff claims she and other consumers were tricked by the bank into believing they had received loan modifications for their primary mortgages. Chase Bank denies the allegations but has agreed to settle the Chase Bank fees SCRA violation class action lawsuit in the interest of avoiding the continued costs and risks of litigation. Will pay 195 million to more than 200 current and former black financial advisers and their attorneys in a class action. The complaint alleges that beginning in November 2008 Chase began notifying consumers participating in the low APR fixed for life offers that their minimum monthly payment would increase from 2 of the loan balance to 5 of the loan. To grant permanent mortgage modifications if they get class-action status.

Source: chase-sucks.org

Source: chase-sucks.org

November 17 2020. San Francisco CA. I started this process in Feb. JP Morgan Chase Class Action Settlement. District Court Southern District of California alleging that defendants reneged on a promise to modify troubled mortgages.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title chase class action lawsuit loan modification by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.